We look at the issues arising from both short-term and long-term absences and the steps employers can take to manage staff absence effectively and legally.

In the UK, the total economic cost of sickness absence, lost productivity through worklessness, and health-related productivity losses, are estimated to be over £100bn annually.

Incapacity for work is generally understood to mean that a person is not fit, through illness or injury, to perform their duties. There is a statutory definition of incapacity, for the purposes of statutory sick pay (SSP).

The main issues an employer will need to consider when dealing with sick employees include:

- Entitlement to SSP and/or contractual sick pay, including deciding whether qualifying conditions have been met. Many employers will have sickness policies which set out relevant qualifying conditions.

- The reason for absence, and whether it is genuine. This will entail ascertaining the true medical position and may involve seeking a medical report.

- Whether the incapacity has been caused by workplace factors such as stress, bullying or an accident at work.

- Whether the absence coincides with any periods of holiday.

- Whether the absence is related to a disability and whether any reasonable adjustments may need to be made.

- Considering whether the employee may be eligible for permanent health insurance or ill-health retirement.

- Whether dismissal is appropriate and, if so, ensuring a fair process is followed.

Having an effective policy in place will help employers to deal with absences consistently and effectively as well as putting employees on notice as to the standards of attendance and reporting that the employer expects from them. This in turn will help reduce legal risk.

Sickness Absence Reporting Requirements

Employers should ensure that they set out the reporting requirements for staff who are unable to attend work due to illness or injury. Employers will have differing views on the time by which absence must be reported. In many workplaces it may not be practicable to notify anyone earlier than the normal opening time at that workplace. However, where staff work shifts, the workplace may be open long before the employee’s shift starts (or even open 24 hours a day) in which case the employer may require sickness to be notified at least an hour in advance of the start of a shift, so that cover can be arranged if necessary.

Evidence of Incapacity

For the purposes of company sick pay, an employer is free to choose what evidence of incapacity it requires. Many employers require self-certification for up to seven days’ absence, and a medical certificate thereafter, as this is in line with the statutory sick pay (SSP) requirements. For SSP purposes, an employer cannot require a doctor’s certificate for the first seven days of sickness absence. Whether they do so after that is largely up to the employer, but most do. Strictly speaking, employees need not self-certify absence of less than four days for SSP purposes, as SSP is not paid for the first three days of absence. However, an employer may still wish to ask for self-certification of shorter periods as part of its absence management strategy.

Employers can in theory require a doctor’s certificate for all absences as a pre-requisite of company sick pay, although this is rare. Many employers require self-certification. (See Practice note, Managing sickness absence: Evidence of incapacity.)

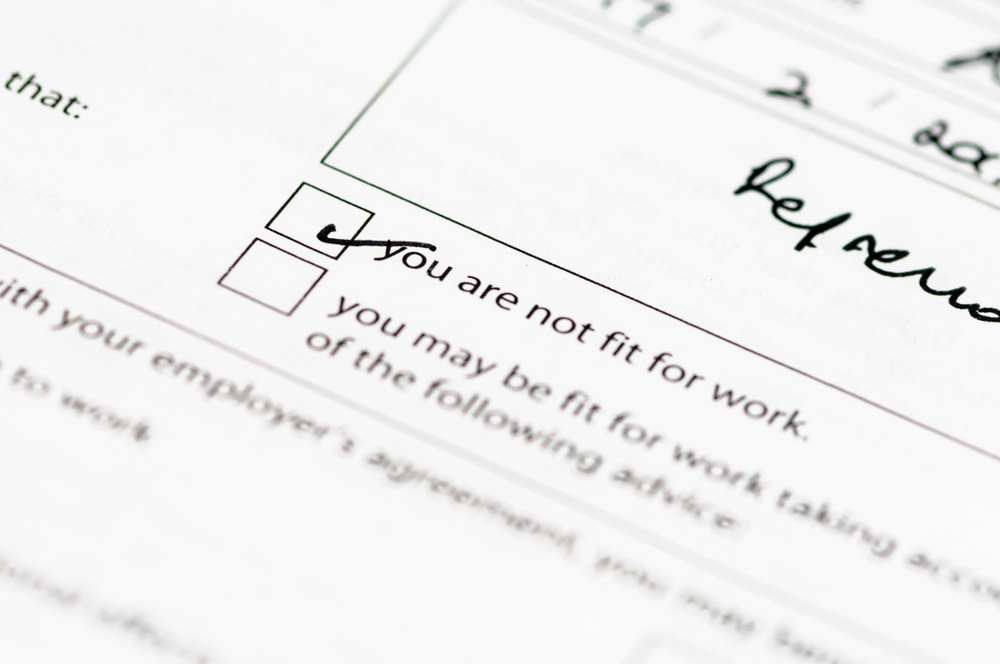

The “Statement of Fitness to Work” (or “fit note”, which replaced the old-style sick note in April 2010) enables GPs to certify that an employee is “not fit for work” or that they “may be fit for work” taking account of advice that the GP then sets out. This may include recommendations such as a phased return to work, altered hours or duties, or other adaptations. When presented with these statements, employers should generally hold a return-to-work interview to discuss any changes that may be needed.

Return to Work Interviews

Return-to-work interviews give an employer the opportunity to welcome a member of staff back to work. In addition:

- They provide the opportunity to confirm the details of the absence for record-keeping purposes.

- The provide an opportunity to discuss any changes that might be needed to facilitate a return to work.

- In the case of someone who has had several short, intermittent absences (and who is unlikely to be on a phased return-to-work programme), they provide the opportunity to establish whether there may be any underlying health or other (for example, disciplinary) issues that the employer should investigate further.

An effective sickness absence policy can fulfil several purposes. First, it sets out the employer’s sick pay arrangements including the rates of pay and the requirements for notifying and providing evidence of incapacity. It is a legal requirement that terms and conditions relating to incapacity for work due to sickness or injury, including any provision for sick pay, are given to the employee in writing. This can be done either in the “principal statement” of employment terms given under section 1 of the Employment Rights Act 1996 (ERA 1996), or in a reasonably accessible document such as a staff handbook, referred to in the statement. (Section 1(4)(d)(ii), ERA 1996.).

Second, the policy provides a procedure for managing longer-term incapacity including obtaining medical evidence, considering alternatives for rehabilitating the employee into work (including any reasonable adjustments for disability under the Equality Act 2010), and ultimately providing a fair procedure for dismissal where this is the appropriate course of action.

Managing Long-term or Persistent Absence

The purpose of a sickness absence meetings procedure is for employers to address issues caused by illness, as well as staff being away from and not contributing to its business. Issues are likely to arise when it is believed that illness is not genuine or where repeated periods of absence or long-term absence are impacting on colleagues, departments, and the employer’s business.

The procedure needs sufficient flexibility to deal with each individual case. Employers should consider adjourning any meeting in the procedure to consider any new matters if they arise. As soon as a case is identified as a conduct rather than an ill-health issue, it should be transferred and dealt with under the employer’s disciplinary procedure.

While it would seem probable that the right to be accompanied does not extend to meetings which are not disciplinary in nature, including those relating to ill-health, providing the right to be accompanied and adding the discretion for the employer to exercise flexibility would be prudent. Whether, and to what extent, discretion is exercised can only be decided on a case-by-case basis.

Medical Examinations

Medical advice can:

- Establish the reason for absence and whether any illness is genuine.

- Indicate the likely length of continued absence.

- Assess the effect of an illness on an employee’s ability to do their job, what they are capable of and what, if any, adjustments can be made to help them to return to work.

- Assist in arranging a phased return to work from long-term sickness absence.

- Establish whether an employee is likely to qualify for any employment benefits, such as permanent health insurance (PHI) or early ill-health retirement.

Highlighting the potential to ask for medical advice may put off employees who are minded to “fake” illness to take time off work. It also draws attention to the need to co-operate with the employer’s attempts to understand ill health absence.

The steps an employer must take when requesting a medical report (whether from a general practitioner, a specialist consultant, a company doctor, or an occupational health specialist), must take the impact of the Access to Medical Reports Act 1988 and data protection legislation into consideration.

Stage One: Initial Sickness Absence Meeting

The purposes of the first meeting will depend on the type of sickness absence being investigated and whether any potential conduct issues have arisen in the individual case.

Prior to convening the initial sickness absence meeting, full details of the absence record along with reasons should be made available to all participants. The employee should be made aware of the date and location of the formal meeting and the reasons for it. In addition, they should be informed of the right to be accompanied by a work colleague or trade union representative at the meeting.

In cases of long-term sickness absence, the central issues will be the nature of the employee’s illness, how much longer they are likely to be away and whether they are going to be able to return to their job. It may be too early to predict a return date and it may be decided to obtain medical advice (either from the employee’s and/or the employer’s medical advisers) on both this and the employee’s ability to resume their job/adjustments at this stage.

In cases of intermittent absences, the issue may be the cause of the employee’s absences and the likelihood of recurrence. An employer may need to explain the impact that the absences are having on the employee’s colleagues and on the employer’s business. It may be decided to obtain medical evidence on the nature of the employee’s illness, the likelihood of recurrence and any steps that can be taken to reduce recurrence.

A meeting can end with a summary of matters discussed and action that it has been agreed will be taken. This can then be confirmed in writing as detailed under the procedure.

Stage Two: Second Sickness Absence Meeting

After the first stage of the sickness absence procedure, the second stage provides for further meetings with a view to resolving difficulties caused by short-term intermittent absences and the return to work of an employee on long-term sickness absence.

The second stage of the procedure should be designed to be flexible, accommodating the individual characteristics of each case. The suggested purposes of the further meetings in the procedure can act as a checklist for employers, to ensure that they are considering those matters relevant to a fair and non-discriminatory dismissal (should it ultimately terminate the employee’s employment).

Stage Three: Final Sickness Absence Meeting

The third stage of the procedure is reached when meetings under the second stage have not achieved their intended aim (overseeing a long-term absentee’s return to work or the eradication of sporadic absences).

This meeting should provide the employer with an opportunity to review the action it has taken to achieve its aim, why they have not worked and whether there is any reasonable prospect that waiting any further will be productive. The meeting also provides the employee with the opportunity to put forward anything that they consider the employer should have done.

Otherwise, the final meeting is likely to result in the termination of the employee’s employment. The employer should check that all prior warnings that it is relying on in making the decision to dismiss are valid. Failure to do so may result in a dismissal being unfair.

Appeals

If the decision is taken to dismiss the employee, they must be informed of their right to appeal against this decision.

Do You Need Assistance to Manage Sickness Absence Effectively and Legally?

The specialist employment law team at Employment Law Services (ELS) LTD have extensive experience in advising UK Employers on their legal obligations to ensure compliance. If you have any queries about your legal obligations you can call us on 0800 612 4772, Contact Us via our website or Book a Free Consultation online.

Advice on Settlement Agreements Employees

Advice on Settlement Agreements Employees Advice on Settlement Agreements Employers

Advice on Settlement Agreements Employers